Contribution Margin Format Income Statement

5.3 The Contribution Margin Income Statement

Learning Objective

- Prepare a contribution margin income statement.

After further work with her staff, Susan was able to suspension downward the selling and authoritative costs into their variable and fixed components. (This procedure is the same equally the 1 we discussed earlier for production costs.) Susan then established the price equations shown in Tabular array 5.v "Cost Equations for Bikes Unlimited".

Table 5.5 Cost Equations for Bikes Unlimited

| Production costs | Y = $43,276 + $53.42X |

| Selling and administrative costs | Y = $110,000 + $9.00X |

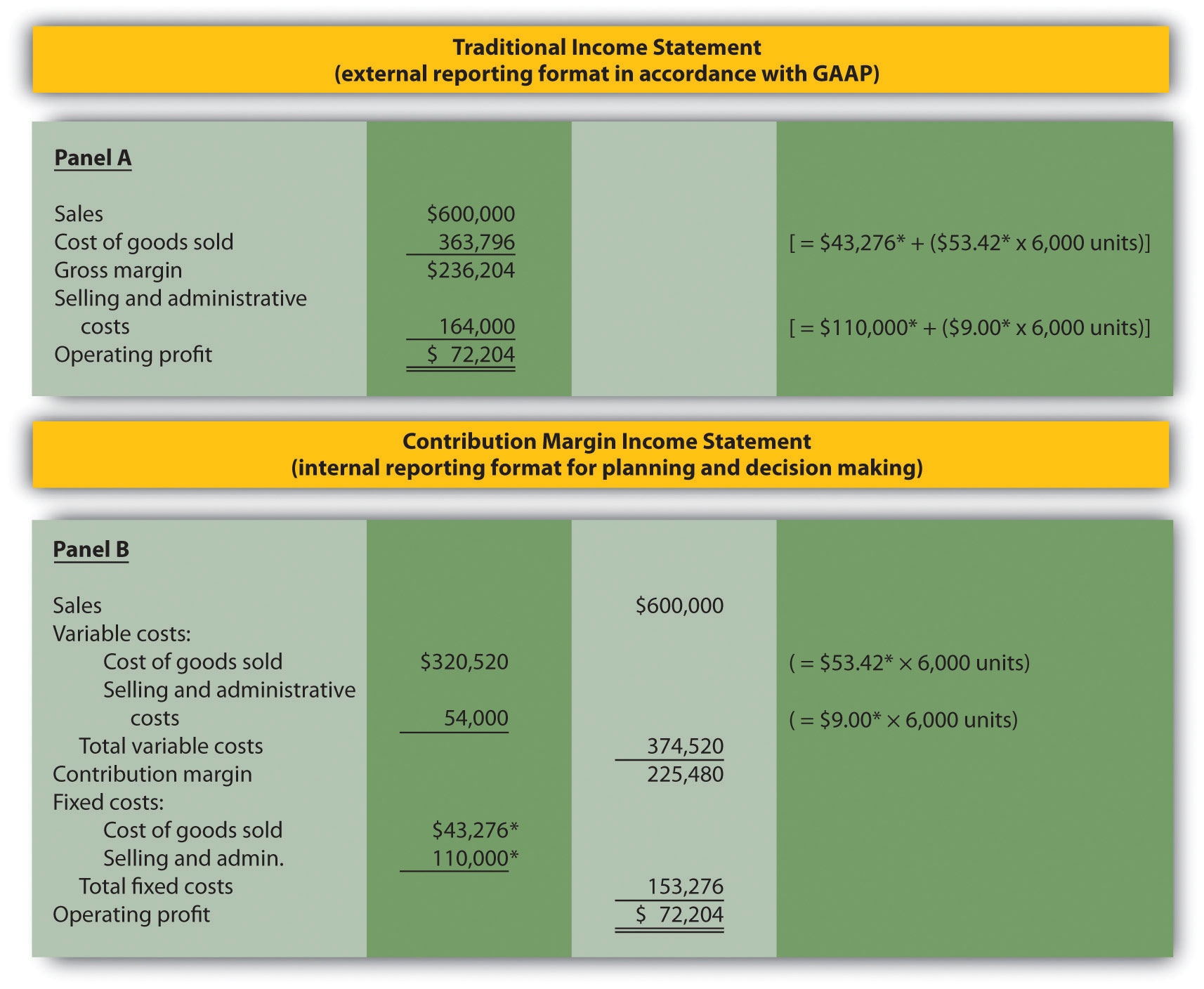

Question: The challenge at present is to organize this information in a way that is helpful to management—specifically, to Eric Mendez. The traditional income argument format used for external financial reporting just breaks costs down by functional area: cost of goods sold and selling and administrative costs. It does not testify fixed and variable costs. Panel A of Figure 5.7 "Traditional and Contribution Margin Income Statements for Bikes Unlimited" illustrates the traditional format. (We defer consideration of income taxes to the end of Affiliate 6 "How Is Price-Book-Profit Analysis Used for Decision Making?".) How can this information be presented in an income argument that shows fixed and variable costs separately?

Reply: Some other income argument format, called the contribution margin income statementAn income statement used for internal reporting that shows stock-still and variable cost information. , shows the fixed and variable components of price information. This blazon of statement appears in panel B of Figure 5.7 "Traditional and Contribution Margin Income Statements for Bikes Unlimited". Note that operating profit is the same in both statements, just the organization of data differs. The contribution margin income argument organizes the information in a way that makes information technology easier for direction to assess how changes in production and sales will affect operating profit. The contribution marginSales acquirement left over after deducting variable costs from sales. represents sales revenue left over after deducting variable costs from sales. It is the amount remaining that volition contribute to covering fixed costs and to operating profit (hence, the proper name contribution margin).

Eric indicated that sales volume in August could increase by 20 percent over sales in June of 5,000 units, which would increase unit sales to six,000 units [= 5,000 units + (v,000 × twenty percent)], and he asked Susan to come up up with projected profit for August. Eric as well mentioned that the sales price would remain the same at $100 per unit. Using this information and the cost estimate equations in Table v.5 "Toll Equations for Bikes Unlimited", Susan prepared the contribution margin income argument in panel B of Figure 5.vii "Traditional and Contribution Margin Income Statements for Bikes Unlimited". Assume for at present that half dozen,000 units is only within the relevant range for Bikes Unlimited. (Nosotros will talk over this assumption later in the chapter.)

Figure 5.7 Traditional and Contribution Margin Income Statements for Bikes Unlimited

*From Table 5.5 "Toll Equations for Bikes Unlimited".

The contribution margin income statement shown in panel B of Figure 5.7 "Traditional and Contribution Margin Income Statements for Bikes Unlimited" clearly indicates which costs are variable and which are fixed. Remember that the variable cost per unit remains constant, and variable costs in total change in proportion to changes in activity. Because 6,000 units are expected to exist sold in August, full variable costs are calculated by multiplying 6,000 units by the toll per unit of measurement ($53.42 per unit of measurement for cost of goods sold, and $ix.00 per unit for selling and administrative costs). Thus full variable cost of goods sold is $320,520, and total variable selling and authoritative costs are $54,000. These two amounts are combined to calculate total variable costs of $374,520, equally shown in panel B of Figure 5.7 "Traditional and Contribution Margin Income Statements for Bikes Unlimited".

The contribution margin of $225,480 represents the sales revenue left over later on deducting variable costs from sales ($225,480 = $600,000 − $374,520). It is the corporeality remaining that will contribute to covering stock-still costs and to operating profit.

Remember that total fixed costs remain constant regardless of the level of activity. Thus fixed cost of goods sold remains at $43,276, and fixed selling and administrative costs stay at $110,000. This holds truthful at both the 5,000 unit level of activity for June, and the half-dozen,000 unit level of activity projected for August. Total stock-still costs of $153,276 (= $43,276 + $110,000) are deducted from the contribution margin to calculate operating profit of $72,204.

Armed with this information, Susan meets with Eric the side by side day. Refer to panel B of Figure five.7 "Traditional and Contribution Margin Income Statements for Bikes Unlimited" equally yous read Susan'southward comments about the contribution margin income statement.

Susan: Eric, I have some numbers for you. My project for August is complete, and I look profit to exist approximately $72,000 if sales volume increases xx percent. Eric: Excellent! You were correct in figuring that profit would increase at a higher charge per unit than sales considering of our fixed costs. Susan: Here's a re-create of our projected income for August. This income statement format provides the variable and fixed costs. As you lot can see, our monthly fixed costs total approximately $153,000. Now that we have this information, nosotros can easily make projections for different scenarios. Eric: This will be very helpful in making projections for future months. I'll accept your August projections to the direction grouping this afternoon. Thanks for your help!

Business concern in Action 5.3

Costs at Lowe'southward Companies, Inc.

Lowe'south is the world'due south second largest dwelling house comeback retailer with more than one,700 stores in the Us, Canada, and Mexico. The company has 234,000 employees. The following financial information is from Lowe's income statement for the year ended January 28, 2011 (amounts are in millions). Which of the visitor's costs are likely to be variable?

Variable costs probably include cost of sales (the cost of goods sold) and a portion of selling and general and administrative costs (east.g., the cost of hourly labor). Cost of sales alone represents 65 percent of net sales (rounded). Retail companies like Lowe's tend to take higher variable costs than manufacturing companies like General Motors and Boeing.

Key Takeaway

- The contribution margin income statement shows fixed and variable components of price information. Revenue minus variable costs equals the contribution margin. The contribution margin minus fixed costs equals operating profit. This statement provides a clearer picture of which costs change and which costs remain the same with changes in levels of activity.

Review Problem 5.7

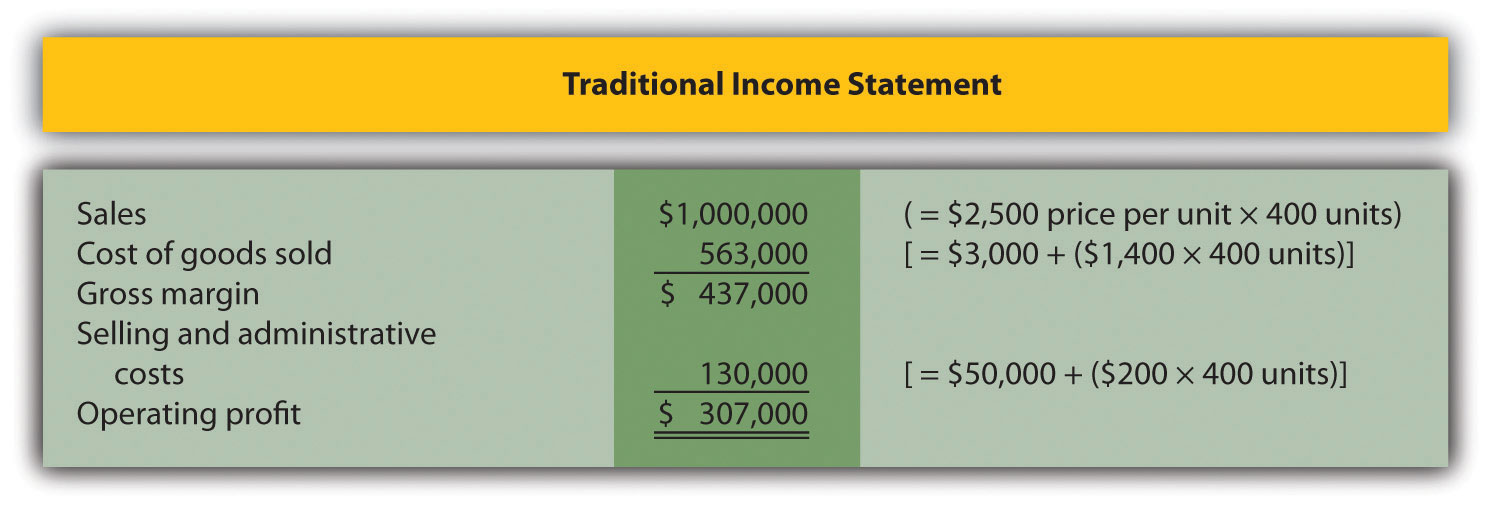

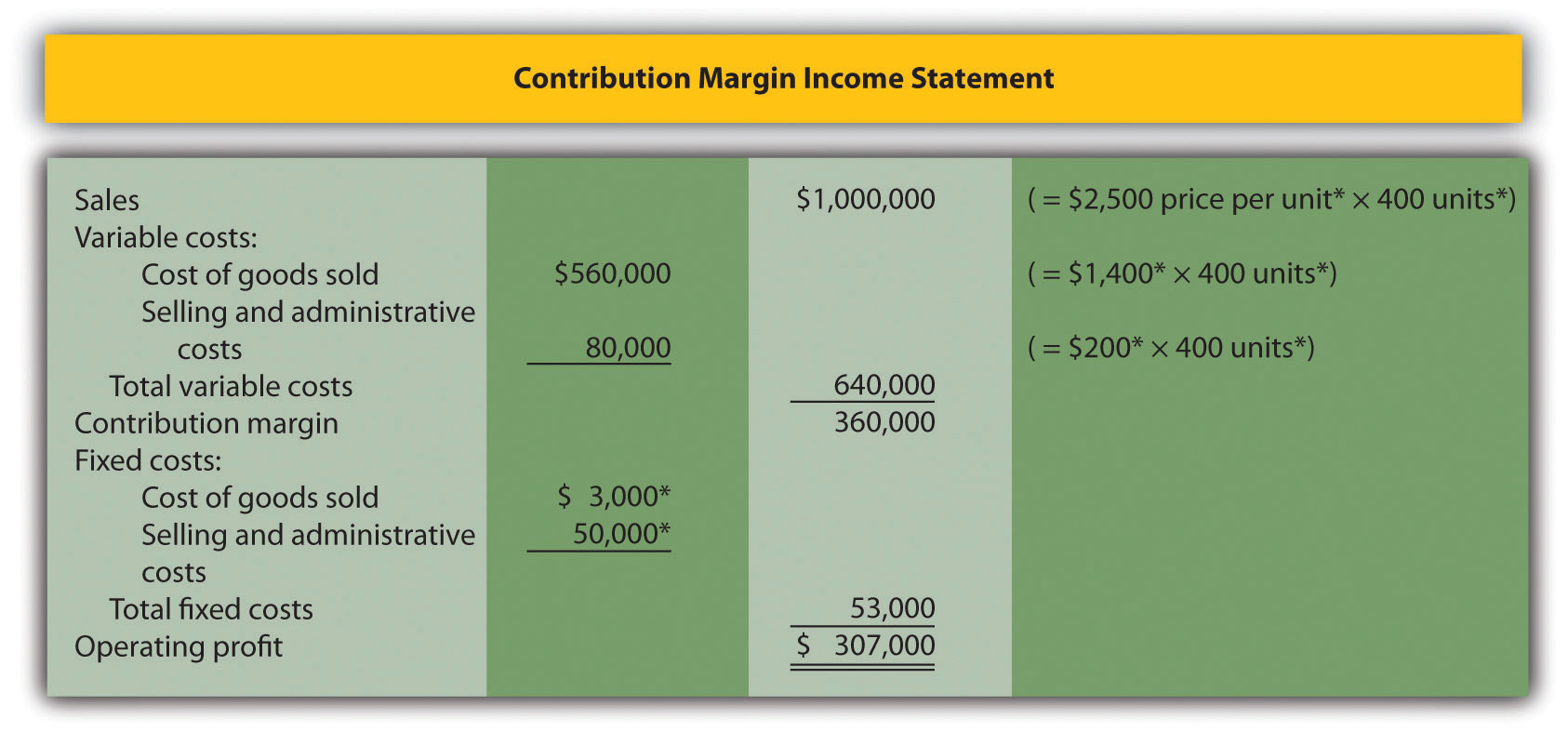

Terminal month, Alta Production, Inc., sold its production for $2,500 per unit of measurement. Fixed production costs were $3,000, and variable product costs amounted to $1,400 per unit. Fixed selling and authoritative costs totaled $fifty,000, and variable selling and authoritative costs amounted to $200 per unit of measurement. Alta Production produced and sold 400 units last month.

Prepare a traditional income statement and a contribution margin income statement for Alta Production. Use Figure 5.seven "Traditional and Contribution Margin Income Statements for Bikes Unlimited" equally a guide.

Solution to Review Trouble 5.7

*Given.

Contribution Margin Format Income Statement,

Source: https://saylordotorg.github.io/text_managerial-accounting/s09-03-the-contribution-margin-income.html

Posted by: cogswellreacquink.blogspot.com

0 Response to "Contribution Margin Format Income Statement"

Post a Comment